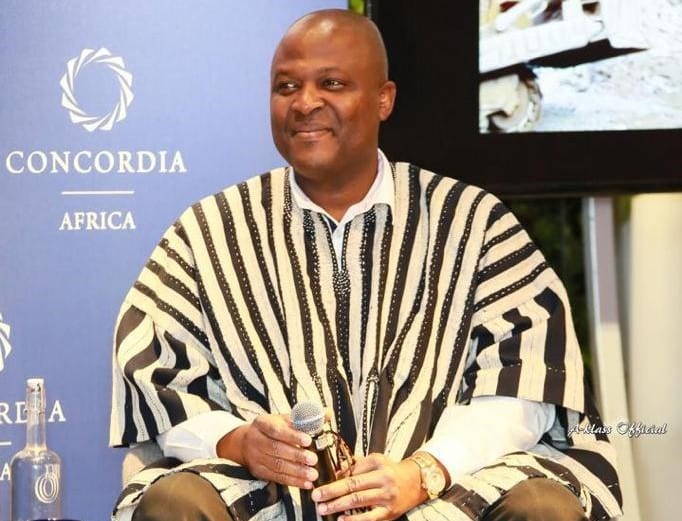

A new twist has emerged in Ghana’s most talked-about mining takeover, as policy analyst and Vice President of IMANI Africa, Bright Simons, has publicl

A new twist has emerged in Ghana’s most talked-about mining takeover, as policy analyst and Vice President of IMANI Africa, Bright Simons, has publicly accused Engineers & Planners (E&P) of misleading the public and stakeholders over its $100 million gold acquisition deal involving the Black Volta Gold Project.

The accusations come barely days after E&P, a mining and logistics company owned by businessman and brother of President John Mahama, Ibrahim Mahama, held a high-profile signing ceremony in Accra on July 7, touting a $100 million Acquisition Facility Agreement secured with the ECOWAS Bank for Investment and Development (EBID).

The funds, E&P said, were to finance the acquisition and development of the Black Volta Gold Mine, which the company claimed would be Ghana’s first large-scale, wholly-owned indigenous gold mining project.

Azumah Resources Denies Involvement

However, the deal has since come under intense scrutiny after Azumah Resources Ghana Ltd, the rightful owner of the Black Volta Gold concession, publicly denied having any formal arrangement with Engineers & Planners.

In a press release issued on July 8, Azumah Resources categorically stated that E&P “does not own any shares in Azumah” and has “not made any formal offer to invest in or fund” its operations.

Azumah’s statement further emphasized that development of the Black Volta Gold Project remains entirely under its control and will be executed in accordance with Ghanaian laws and regulatory frameworks.

Simons Alleges Use of Azumah’s Letterhead

Speaking on Channel One TV’s “The Point of View”, Bright Simons raised serious concerns about the authenticity and transparency of the financing deal.

According to him, E&P went as far as using Azumah’s official letterheads to create the impression of consent and cooperation between the two entities—something he described as “deeply troubling.”

“I saw documents that used Azumah Resources letterheads, suggesting that Azumah had agreed to sell their mine to E&P with EBID coming on board to finance. That, to me, was not just misleading—it was a gross misrepresentation,” Simons explained.

Implications for Due Diligence and Institutional Trust

The revelations have sparked public debate about due diligence lapses in high-value financial transactions and the responsibilities of state and regional financial institutions in verifying the accuracy of representations made by loan applicants. EBID, a major financier in the deal, has yet to issue a public response to the controversy.

This incident has also revived tensions between Simons and E&P, especially considering a recent defamation lawsuit filed by Ibrahim Mahama against the IMANI Vice President.

Simons has previously accused Mahama and his companies of circumventing accountability in several high-value projects, including public sector contracts.

In April 2025, E&P demanded a public retraction from Simons over what they described as “false and malicious claims” concerning their operations.

The current controversy appears to deepen that rift and may further entrench legal battles between both parties.

E&P’s Silence Raises More Questions

As of press time, Engineers & Planners has not responded directly to the fresh allegations of document misrepresentation.

COMMENTS